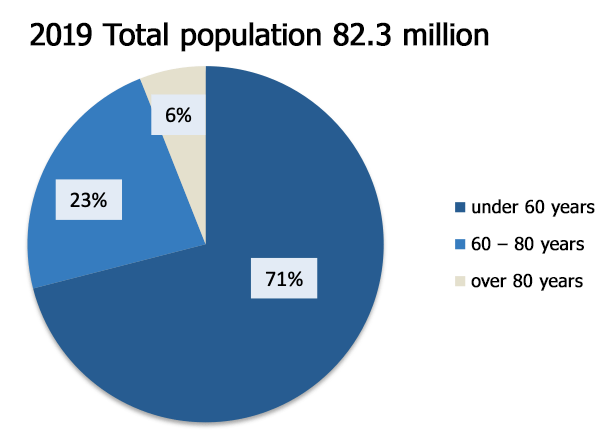

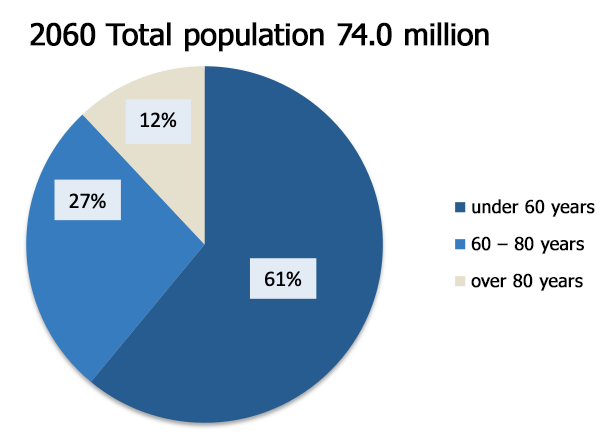

The market for nursing care real estate is characterized by a structurally growing demand: according to a forecast by the Wissenschaftliches Institut der AOK (Scientific Institute of the AOK), the number of people in need of care will rise from around 3.5 million at present to around 4.4 million in 2040. The number of senior citizens living in households will also rise from the current level of around 12 million to around 15.6 million.

According to an analysis by ARGE eV, only eight percent of this group already live in housing suitable for the elderly. In Germany, therefore, significantly more nursing homes as well as senior-friendly and assisted living apartments will be needed in the future. The structural growth of the sector is increasingly attracting real estate investors. However, the investment market for care properties is a niche segment and is still relatively intransparent.

Transaction volumes have risen noticeably in recent years, due to the significant increase in demand and progressive institutionalization of the market.

The start of 2022 was associated with a great deal of optimism for the real estate market: The effects of the pandemic seemed to have been overcome, and many real estate investors were looking to further expand their portfolios. However, the war of aggression on Ukraine and the interest rate turnaround have noticeably dampened the mood on the German real estate market and led to significantly fewer transactions. In general, many are currently assuming a temporary effect and a normalization of the markets towards the end of the year. Investment pressure remains high, and bond yields are still not at an adequate level despite a noticeable increase. Real estate in markets with positive long-term fundamentals will continue to attract capital.

Source: Savills Research / Gesundheitsimmobilien June 2022

Location Criteria

Operator Criteria

Property Criteria

inpatient care beds that will be needed in addition

full-time nurses needed in addition

new construction and reinvestment required

The maximum risk of the investor consists in the complete loss of his subscription sum and possible fees, in the form of payment obligations to be borne by him possibly from a personal share financing as well as further asset disadvantages in the form of tax payments.

Irrespective of the risks described here, developments that cannot be foreseen today may have a negative impact on the result of an investment. There are no additional funding obligations.

Apart from the risks mentioned above, the Offeror is not aware of any other material, factual and legal risks in connection with the investment at the time of publication of the Investment Offer.

As an existing real estate fund, Anesis Management promotes social properties in accordance with Article 8 of the EU Disclosure Regulation.

Environmental sustainability is pursued under the following guiding principles:

Ecological sustainability is based on the original idea of not overexploiting nature, both in the maintenance of existing properties and in new construction. Ecologically sustainable is a way of life that uses the natural resources only to the extent that they regenerate.

Social sustainability means that an operating society should be organized in such a way that social tensions are kept within limits and conflicts can be resolved peacefully. In addition to social justice, this aspect also stands for humane jobs, education and qualification for the next generation.

Conclusion of Green Lease Agreements for new leases sustainable use and management of the leased property during ongoing operations, reduction of waste, consumption and emissions as well as ecologically sound implementation of maintenance, modernization and other construction measures.

As an existing real estate fund, Anesis Management promotes social properties in accordance with Article 8 of the EU Disclosure Regulation.

Environmental sustainability is pursued under the following guiding principles:

Ecological sustainability is based on the original idea of not overexploiting nature, both in the maintenance of existing properties and in new construction. Ecologically sustainable is a way of life that uses the natural resources only to the extent that they regenerate.

Social sustainability means that an operating society should be organized in such a way that social tensions are kept within limits and conflicts can be resolved peacefully. In addition to social justice, this aspect also stands for humane jobs, education and qualification for the next generation.

Conclusion of Green Lease Agreements for new leases sustainable use and management of the leased property during ongoing operations, reduction of waste, consumption and emissions as well as ecologically sound implementation of maintenance, modernization and other construction measures.